Facing a Thursday due date for their report, the Tax Structure Task Force is working daily this week, sorting through options and preparing to vote on their recommendations.

“If we’re going to spend, we have to decide exactly how we’re going to raise the money,” LSU economist, Dr. Jim Richardson, summed up the charge given to the panel by the governor and the legislature.

He then gave the other dozen task force members a review of what they’d learned meeting nearly weekly for the past four months.

“You look at all the taxes, and there are no gimmes,” Richardson said, which a rueful chuckle.

He then gave them a simple explanation of the economic theory behind what they’re attempting to do.

“You put the broad base, the lowest rates, and typically you accomplish stability, fairness, competitiveness, neutrality and simplicity.”

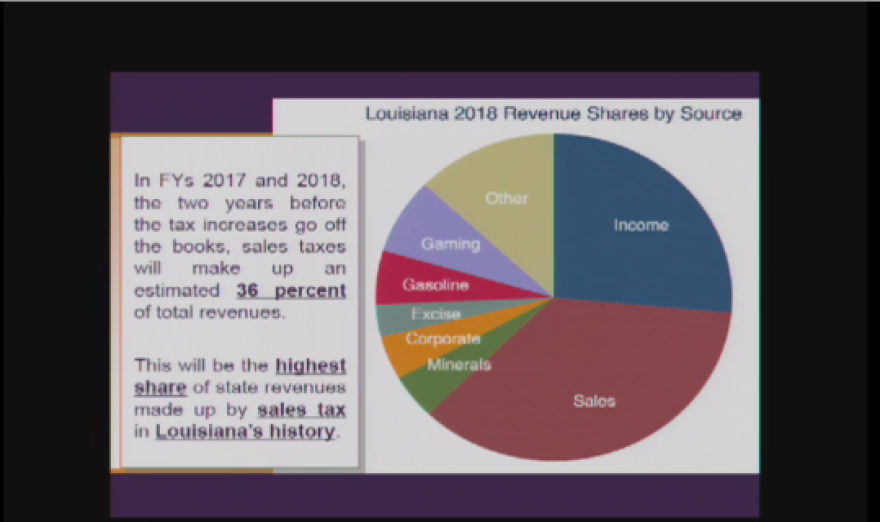

But Louisiana’s base has become increasingly imbalanced, he said, increasingly dependent on sales and personal income tax.

“They make up over 60-percent of our revenues,” Richardson said. “Sales makes up close to 37 percent. Individual makes up close to 26-percent.”

For comparison, 35 years ago, personal income tax was just five percent of Louisiana’s revenue stream, and sales tax a quarter of it. Then, and up till eight years ago, the state relied more on two other revenue streams: corporate taxes and mineral revenues, i.e., oil and gas.

“In 2008, we got about $2.7-billion from minerals and corporate taxes,” Richardson reminded the panel. “When the Legislature gets $2.7 billion in 2008, they make the assumption that this is forever. They build it into their permanent spending categories.”

The sales tax hikes enacted this spring could create some similar assumptions, even though they were designed to be temporary. Because of the flood, purchases of big ticket items – building supplies, vehicles, furnishing, appliances -- will go up, increasing state sales tax income even more.

And for some lawmakers, that’s all the excuse they’ll need not to tackle tax reform next spring.